where do i pay overdue excise tax in ma

The excise is based on information furnished on the application for registration of the motor. General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by the Registry of Motor Vehicles RMV who then sends out billing information to the city or towns assessor.

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

Excise tax is an annual tax on motor vehicles under Massachusetts General Laws Chapter 60A.

. The tax is based on a calendar year and not a fiscal year. Monday-Friday 830 am to 430 pm Terms of Use Government Websites by CivicPlus. If the motor vehicle excise bill is.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. You must make payment directly to their office. The tax must be paid by the registered owner within 30 days of the bills issue.

The tax is levied in lieu of a personal property tax by the municipality of principal garaging of the vehicle. Please contact our Deputy Collector Point Software at 413 526-9737. Deputy collector pks associates inc.

Clicking the payment of choice will display the available options and any associated service fees. Available payment options vary among services and our online payment partners. How do I pay for overdue excise taxes that have been sent to Jeffery Jeffery for collections.

Tax Department Call DOR Contact Tax Department at 617 887-6367 Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089 9. You must make payment directly to their office. You pay an excise instead of a personal property tax.

They are sent to city or town assessors who commit them to the local tax collectors for distribution and collection of payment. Excise tax bills are prepared by the Registry of Motor Vehicles and billed by the local community where the vehicle is garaged. Excise tax bills are due annually for every vehicle owned and registered in Massachusetts.

The minimum excise tax bill is 5. You must make payment in cash money order or cashiers check to have the mark removed immediately. Please contact the treasuercollectors office or our Deputy Collector Kelly and Ryan Associates at 508-473-9660.

If you dont pay your excise bill and we deny your abatement you will have to pay any late fees and penalties. If you have any question that have not been answered above call the TreasurerCollectors office at 508-529-3737. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Cities and towns may also prepare their own bills based on excise data sent by the Registry in conformity with Registry requirements. When you fail to pay a motor vehicle excise a tax collector can collect the delinquent excise by placing marking your vehicle registration and operating license in non-renewal status at the Registry of Motor Vehicles RMV. Go to our online system.

The excise tax rate is 25 per 1000 of assessed value. They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website. A collector can also.

Upon failure to pay within 30 days of the notice of warrant the deputy collector will make a service of warrant the charge for which is 17. Contact Us Your one-stop connection to DOR. A motor vehicle excise payment is due 30 days after we issue the bill.

How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. If the excise continues to be outstanding the deputy collector or collector notifies the Registrar of Motor Vehicles within a two year period after the initial excise tax was issued. A collector can also.

If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. Pay your excise tax. If your vehicle isnt registered youll have to pay personal property taxes on it.

If you have not received an Excise Tax Bill for any of your vehicles please contact the Collectors Office at 781-961-0913. Town of Bourne 24 Perry Avenue Buzzards Bay MA 02532-3441 508 759-0600 Office Hours. Jeffery Jeffery will no longer accept cash for bills they collect on behalf of the Tax Collector.

Bring a lawsuit against you within 6 years of the date the excise is due and payable. Payment by check or money order may be mailed to the Office of the City Treasurer. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually.

The City of Worcester accepts payments through our online payment partners. A boat excise payment is due 60 days after we issue the bill. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Kelley Ryan Associates Parking Tickets UniBank Government Services. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. If you plan to file an abatement its a good idea to pay your excise tax.

Monies are both collected and deposited into its respective municipalitys general. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality.

Please contact our Deputy Collector Jeffery Jeffery 137 Main street Ware MA 01082-0720 or by phone at 413-967-9941. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at Town Hall. The Massachusetts Registry of Motor Vehicles prepares bills and distributes them to cities and towns throughout the state for collection.

355 east central street franklin ma 02038. How to file an excise tax abatement. You can pay your excise tax through our online payment.

Massachusetts law sets a minimum assessment at 5 even if calculations produce a lesser amount. Please contact the Town of Winchendon Assessors Office for abatement information.

Excise Tax Gloucester Ma Official Website

Look Up Pay Bills Town Of Arlington

Outstanding Excise Tax Bills Due Before May 10 2022 To Avoid Late Fees City Of Taunton Ma

Why Was A 2 3 Medical Excise Tax Showing Up On Receipts From Sporting Goods Giant Cabela S Words Medical Fun Sports

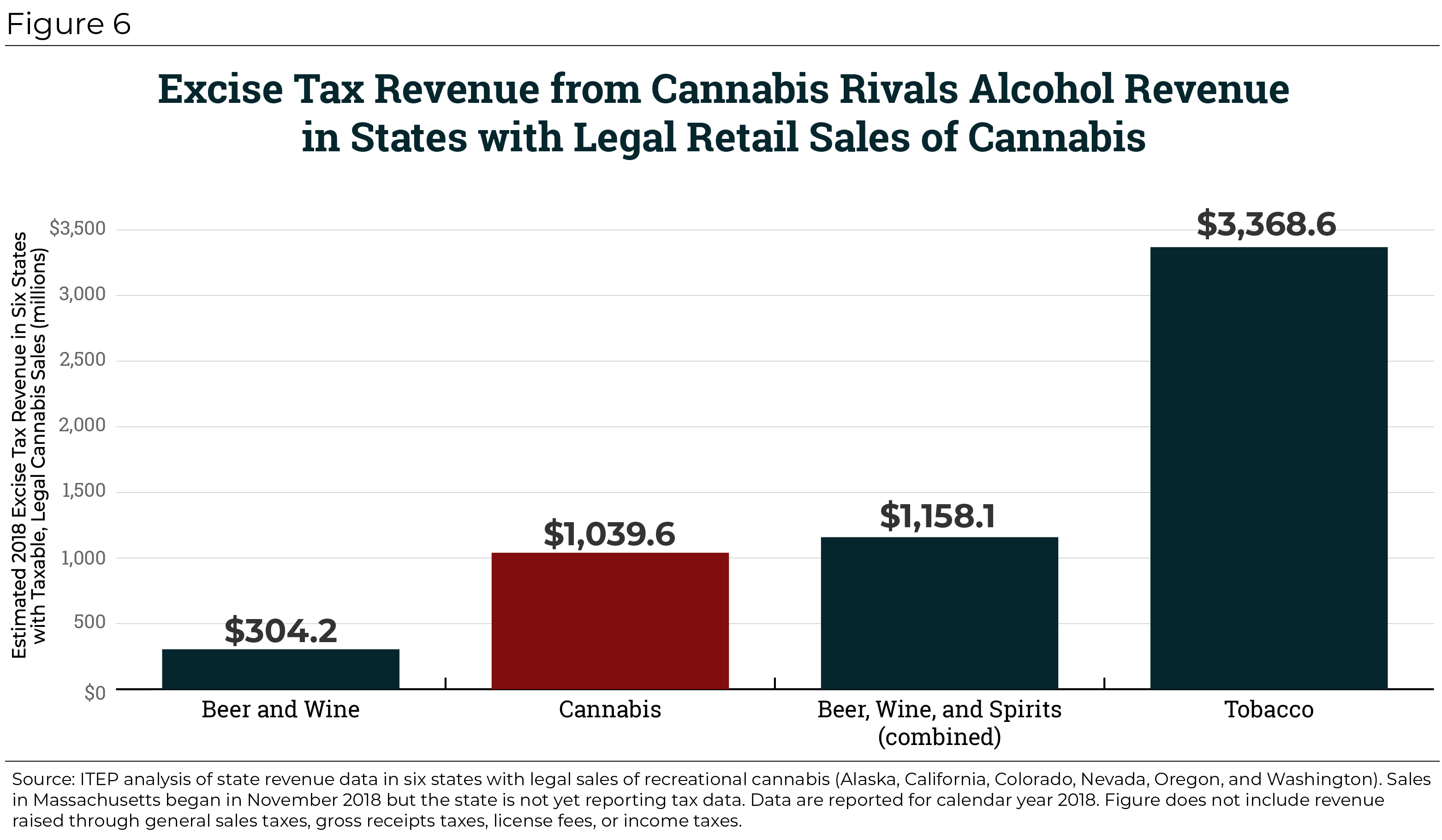

Marijuana Excise Taxes Outpace Alcohol In Massachusetts

Town Of Fairhaven Collector S Office Reminder Excise Tax Bills Were Mailed On February 7 2019 And Are Due On March 8 2019 If You Have Not Received Your Bill Contact The Collector S

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Online Bill Payment Town Of Dartmouth Ma

Canadian Cannabis Producers Overdue Excise Taxes More Than Triple To Ca 52 Million

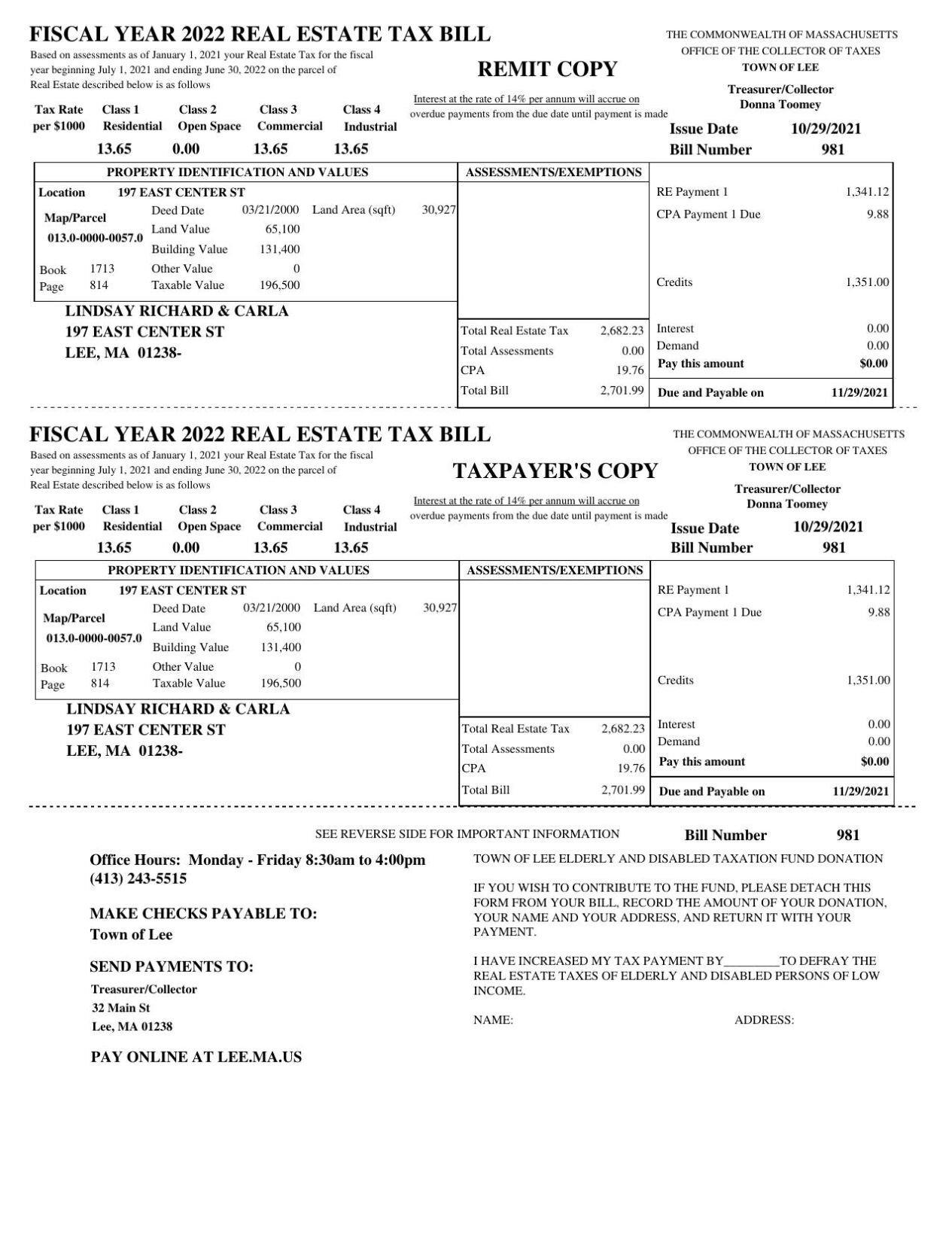

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov