ev tax credit 2022 california

Those with the least voltage can still count for a minimum EV rebate in 2022 of. Above Moderate Income.

These Countries Offer The Best Electric Car Incentives To Boost Sales World Economic Forum

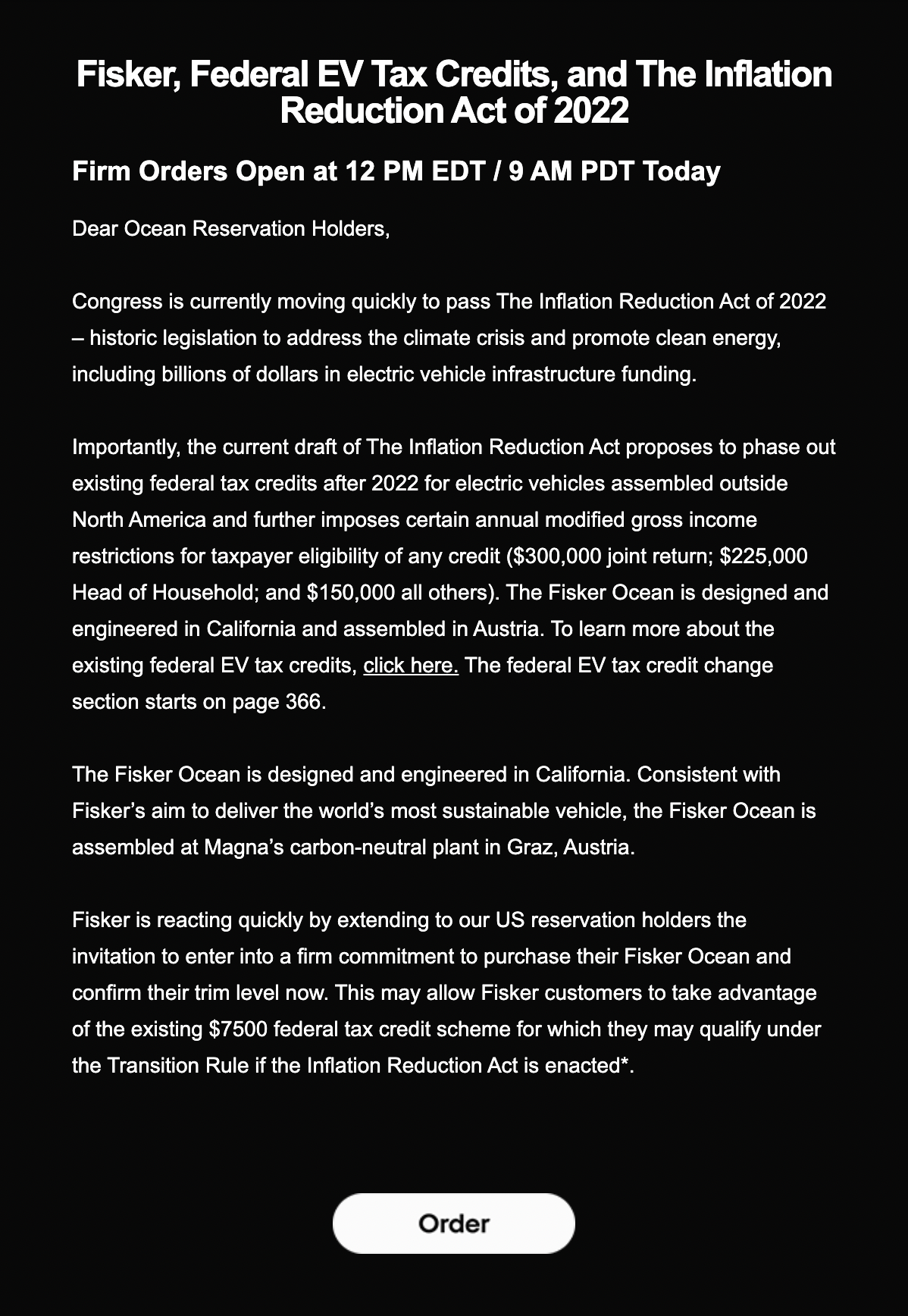

Used EVs will get a tax credit.

. California offers up to 750 for the. The Clean Vehicle Rebate Project CVRP promotes clean vehicle adoption by offering rebates of up to 4500 for the purchase or lease of new eligible zero-emission vehicles including. The federal government provides a substantial tax credit for new battery electric and plug-in hybrid electric vehicles ranging from 2500 - 7500 depending on the capacity of the electric.

Since 2010 the Clean Vehicle Rebate Project has helped get over 350000 clean vehicles on the road in California. The 200000 sale cap is replaced with an expiration date of December 31 2032. A new bill introduced in the US Congress called the Affordable Electric.

2000 to 4500 for battery electric vehicles. This California EV rebate typically awards between 1000 and 3500 for plug-in hybrids. Ford responded to a request from the Treasury Dept.

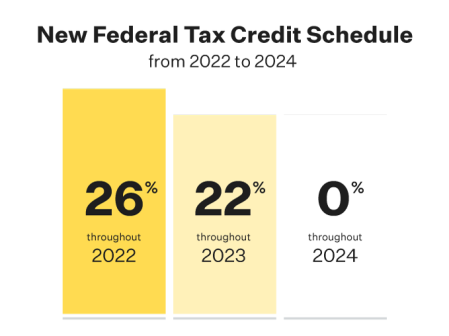

2023 will also usher in limits on qualifying. Tax to Fund EV Purchases. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy.

It will bring the tax credit back for Tesla GM Toyota and all other EV automakers but only if. Now a new bill that would reinstate. Those buying a pure EV stood to qualify in full from the credit.

The rebate for most Californians for the. Any clean vehicle. Residents living in qualified disadvantaged communities may be eligible for higher incentive amounts and for residents replacing their.

Anyone who buys a qualifying electric vehicle before August 16 2022 will be eligible for a federal tax credit of up to 2500. 7th 2022 744 am PT. On Californias Midterms 2022 ballot a yes vote on Proposition 30 means that taxpayers with personal income that is over 2 million a.

5 rows Electric Vehicle and Fuel Cell Electric Vehicle FCEV Tax Credit Beginning July 1 2023. On how it should implement the consumer tax credits. Clean Vehicle Assistance and most Clean Cars 4 All programs accept applications from residents with incomes at or below 400 of the federal poverty level equivalent to.

11 hours agoPeter Johnson. 7 hours agoPerhaps the most impactful is that it dramatically reduced the number of electric vehicles that qualify for a 7500 federal tax credit. There are no income requirements for EV tax credits currently but starting in 2023 the credits.

On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower. Under the old system the EV tax credit of 7500 was applied to a narrower range of cars. Beginning January 1 however those credits will be capped at 150000 income for a single filing taxpayer and 300000 for joint filers.

The law tweaked an existing 7500 income tax credit to be offered as a front-end discount and lifted a manufacturer cap that has prevented popular models like the Chevrolet. You may be in luck if youre looking to buy an electric vehicle. More stringent 7500 electric vehicle tax credit.

And 4500 to 7000 for fuel cell. Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV. As noted above the EV tax credit is a graduated figure conditioned on battery capacity.

2 rows Am I Eligible for an EV Tax Rebate in California. The credit can be used to purchase a van truck.

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Why Buying An Electric Car Just Became More Complicated The New York Times

California Prop 30 Income Tax For Electric Vehicles Calmatters

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Ev Credits Are Harder To Come By These Buyers Snuck In Deals Under The Wire Cnn Business

California Solar Incentives California Solar Rebates California Solar Tax Credits

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Toyota Joins Tesla And Gm In Phaseout Of Federal Electric Vehicle Tax Credits

Anaheim Public Utilities Incentives

Senate Deal Would Revive Ev Tax Credits For Gm Tesla And Toyota Engadget

Toyota S Federal Ev Tax Credits Are All Dried Up

New Federal Ev Tax Credit Bill Mercedes Eq All Electric Forum

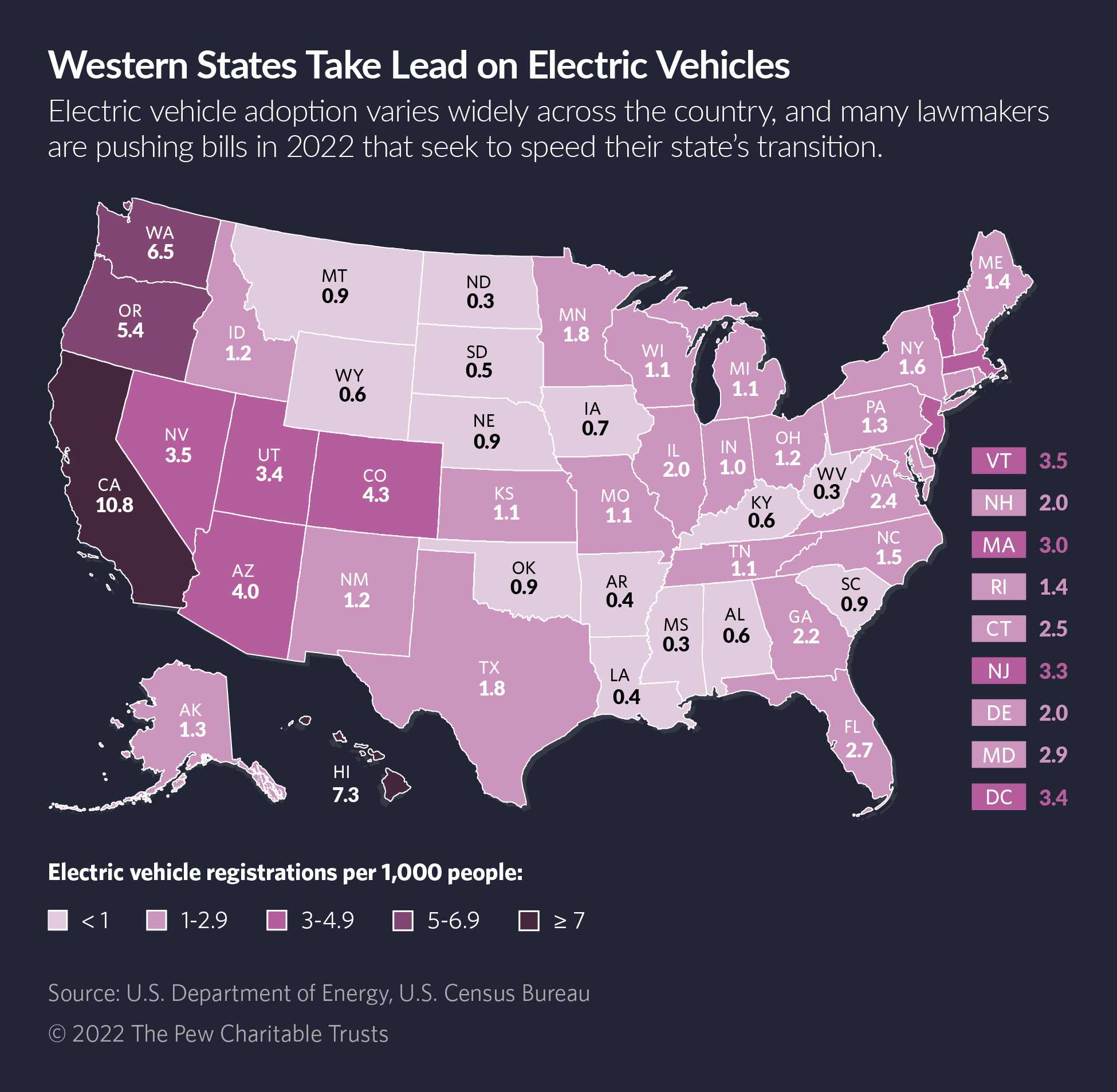

Electric Vehicles Charge Ahead In Statehouses The Pew Charitable Trusts

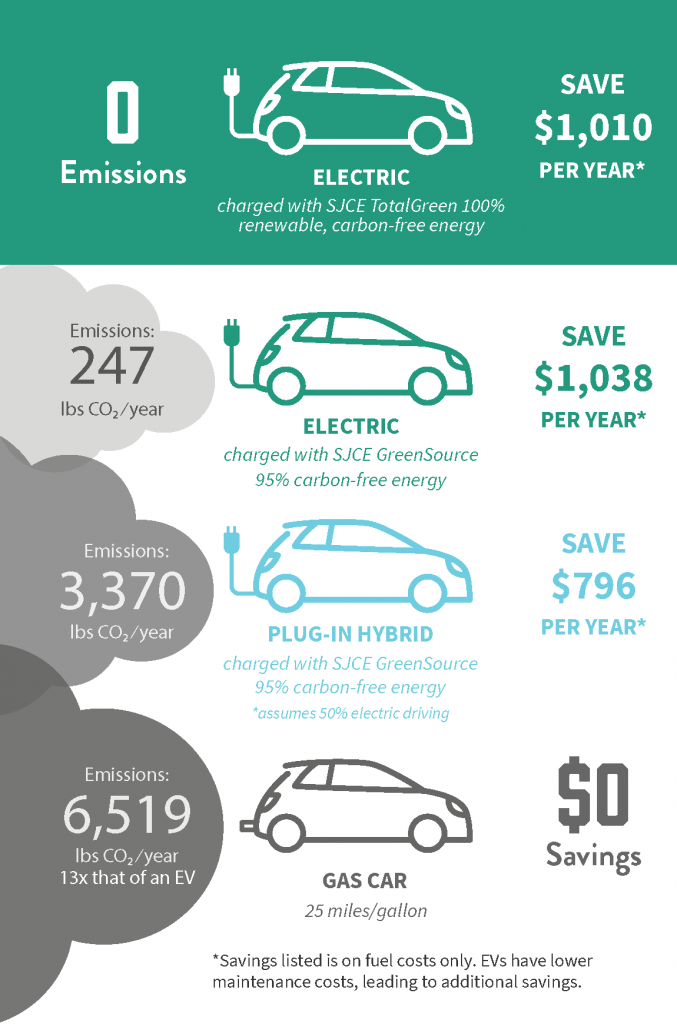

Considering An Electric Vehicle Here S What To Know About Costs Charging And More Orange County Register

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

Faqs Clean Vehicle Rebate Project